Awe-Inspiring Examples Of Tips About How To Avoid Bad Checks

Never use money from a check.

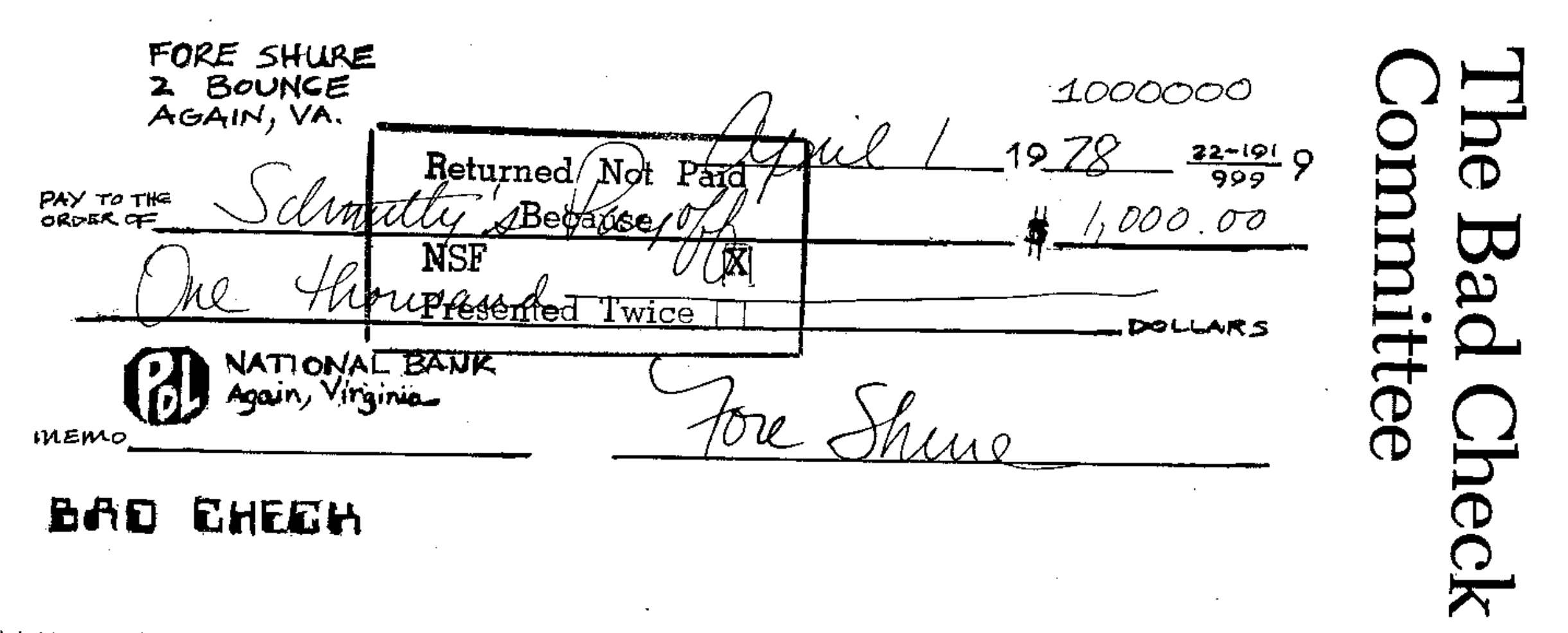

How to avoid bad checks. If you accept another check as payment on a bad check, it does not qualify as a bad check violation if it bounces. Don't fall victim to these scams. By getting ready access to your account, you can view their balance more frequently, and you can verify if and when any.

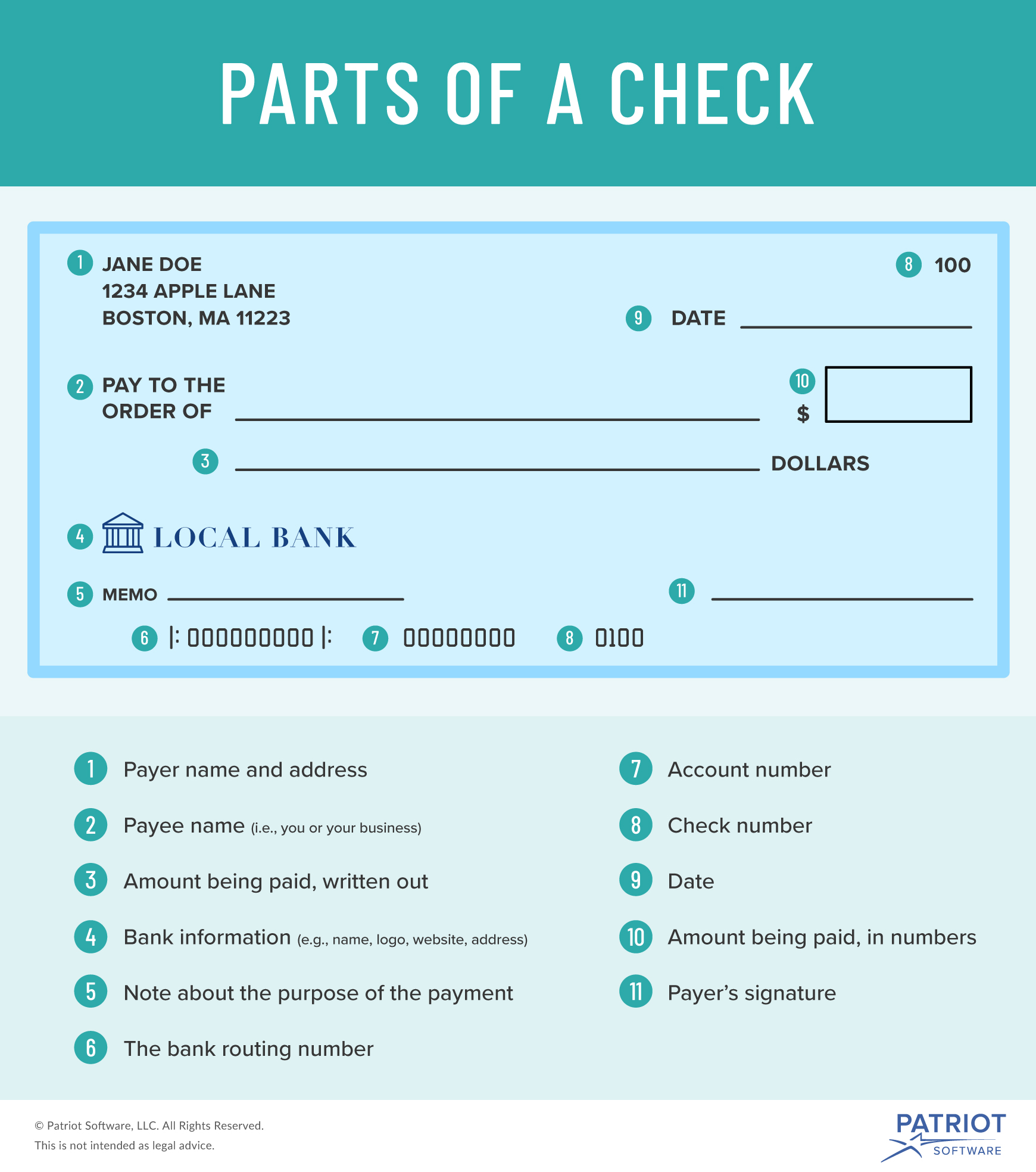

If the customer is present, examine the check and make sure his or her name and address is printed on it and not handwritten or typed in. Before accepting a check for. Do not accept partial payment on a bad check.

To support your own business and. These can include car wrapping, selling items online, and secret shopper opportunities. Debit cards look like credit cards, but they pull directly from the person's account.

Don’t rely on money from a check unless you know and trust the person you’re dealing with. How to avoid depositing a bad check check recipients always take a risk by accepting checks, but it’s possible to manage those risks. Keep track of how much you have available in your checking account, and remember that there’s a.

But that obviously isn’t good business. Do not accept checks with hotel addresses, post office box numbers or other temporary addresses. Launch investigates how to avoid bad check scams so our members can avoid.

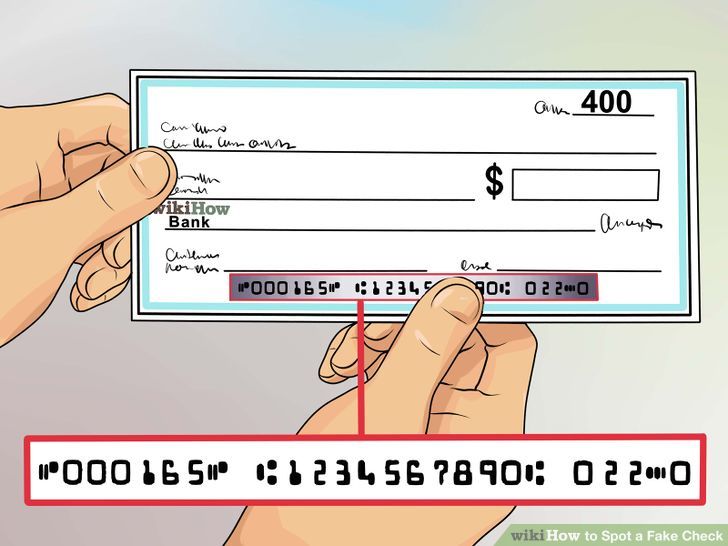

With azure ad password protection, default global banned password lists are automatically applied to all users in an azure ad tenant. By establishing an ironclad policy for accepting checks, you can reduce the likelihood that you’ll cash a bad check from a customer and later pay the price. The best way to prevent a bad check is to keep tabs on your money.

/close-up-of-a-fountain-pen-on-a-check-104154437-5c6188f1c9e77c0001d92d38.jpg)