Beautiful Work Info About How To Avoid Probate Taxes

The best way to avoid probate is to die without any assets in your estate.

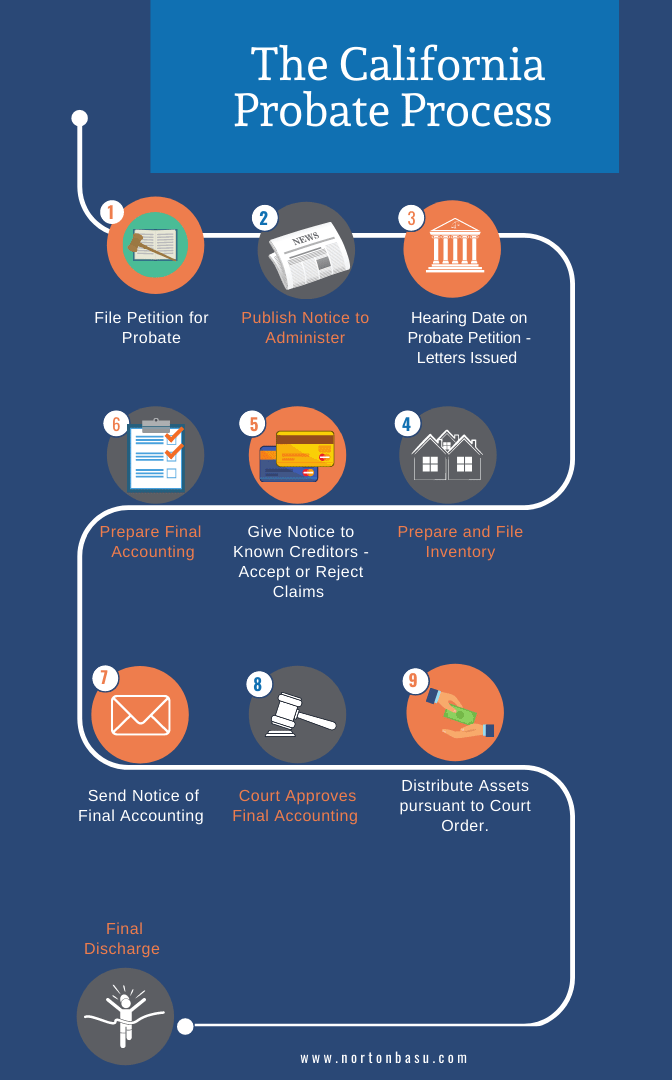

How to avoid probate taxes. Remember, in connecticut avoiding probate will not reduce probate court fees. A pod or tod designation allows you to decide to whom the property will transfer or be paid. Your first responsibility as an estate administrator is to provide the probate court with an accounting of the assets and debts of the deceased.

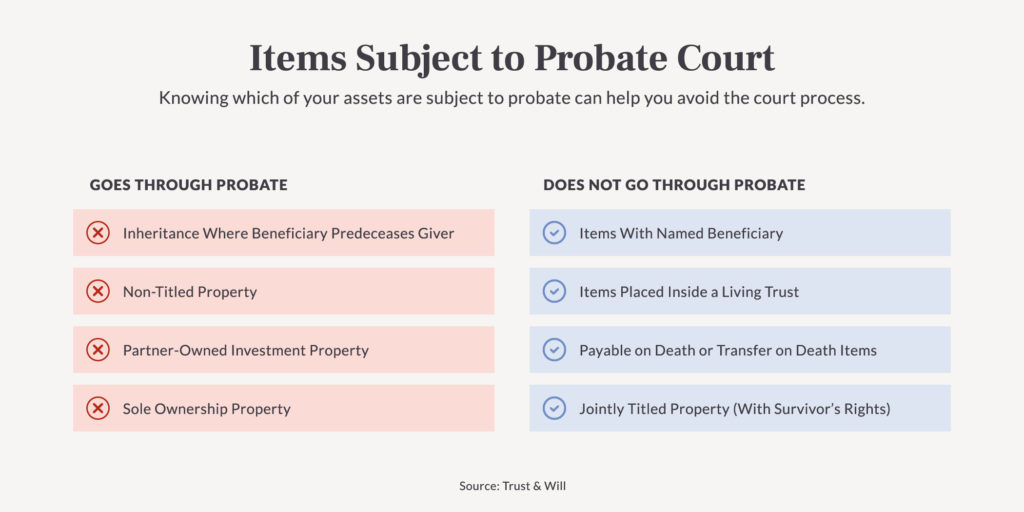

If you pass away with assets titled solely in your name (also known as probate assets), your estate. Joint tenancy with right of survivorship. Designate beneficiaries for retirement plans (rrsps, rrifs, and tfsas) and any life insurance policies.

Have all assets appraised to. Here are some ways to avoid probate in. With this in mind, it is relatively easy to properly structure one’s assets while alive to avoid probate at death.

Reducing an estate’s value can drastically simplify the probate process as well as potentially have positive tax advantages in terms of federal and estate taxes. This isn’t always the best way when you take into account tax and other issues but you can put property (real estate) into joint tenancy with. Instead of having the assets in your estate, the funds skip probate, minimizing the size of your probate estate.

Those with taxable assets can accomplish this. Create joint ownership for real estate. 7 ways to avoid probate 1.

5 you can name beneficiaries for retirement accounts and life. The top three ways to avoid probate 1. Establish joint ownership of property.

![Top Five Strategies For Avoiding Estate Taxes [Infographic] | Indianapolis Estate Planning Attorneys](https://frankkraft.com/wp-content/uploads/2013/09/Top-Five-Strategies-for-Avoiding-Estate-Taxes.jpg)

/TermDefinitions_Probate_finalv12-c74d1819b64a4e60bb4c21f2d0a25aa4.png)