Marvelous Info About How To Keep Track Of Business Mileage

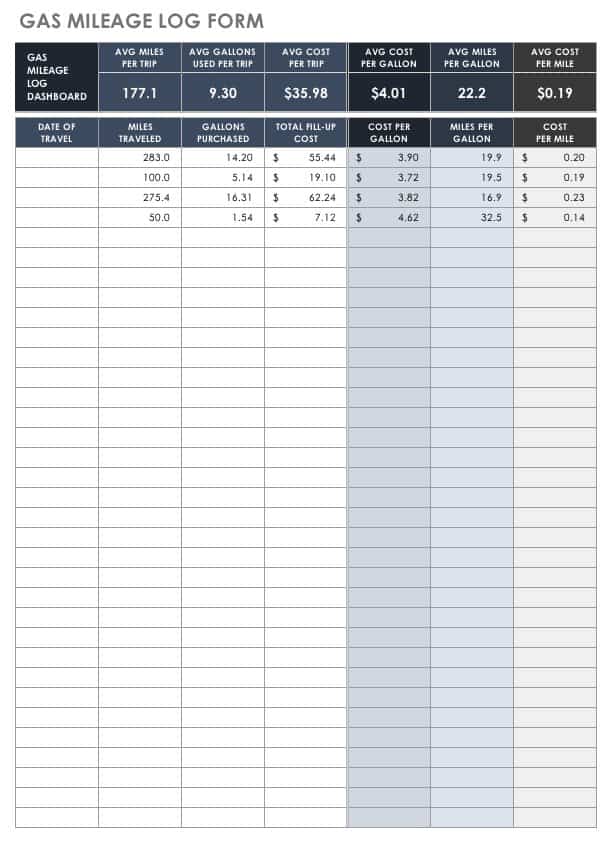

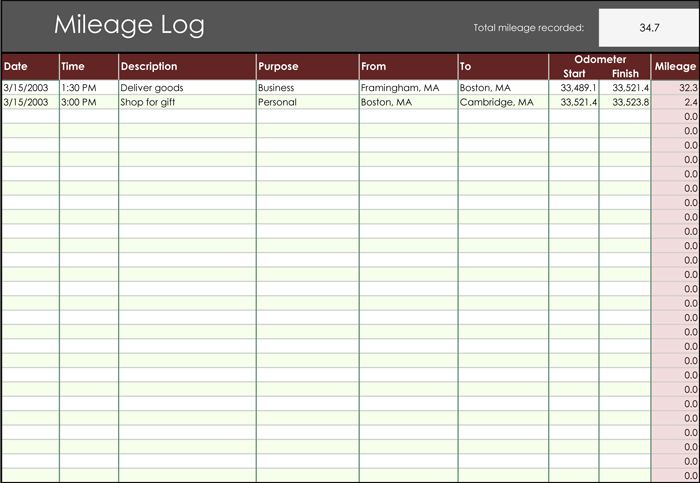

Decide how to log your miles if you do everything electronically, you may want to log your miles on a spreadsheet.

How to keep track of business mileage. A mileage tracker app like mileiq may be one of the easiest ways to provide what the irs wants. The templates help you track the number of miles your vehicle has traveled in a. Download mileiq to start tracking your drives automatic, accurate mileage reports.

Everlance is a business mileage tracker app that allows managers to edit and add trip purposes, vehicle details, and other details that are crucial for mileage tracking. Keep your log on paper and pay with your time (for beginners only!) keep your log with free or cheap software and pay the irs fine. By employing mileage expense tracking, a company can get the following 7 benefits:

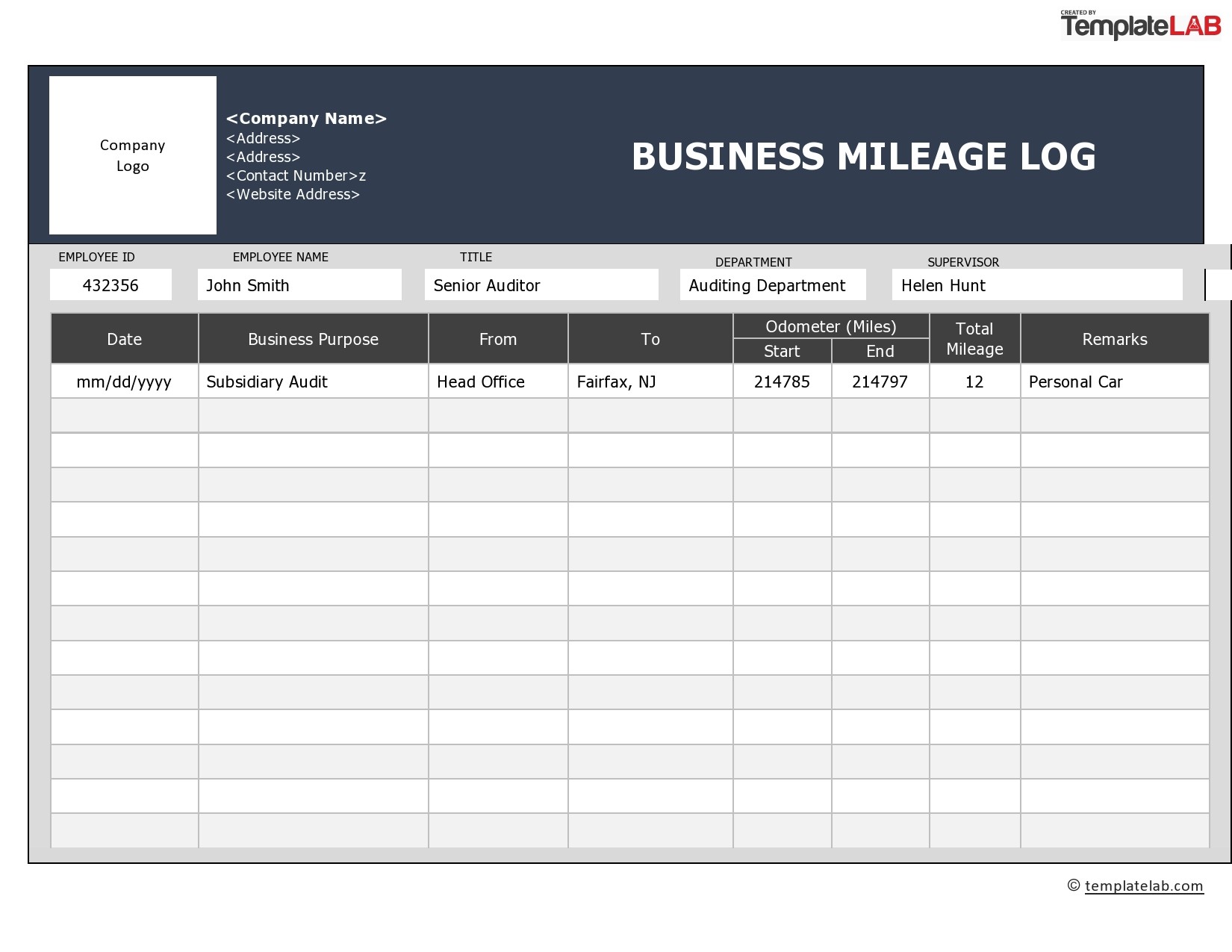

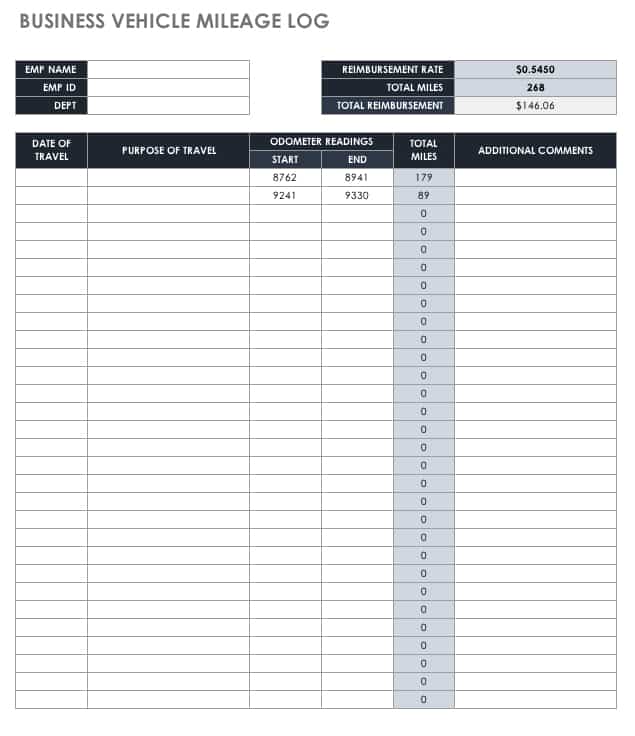

However, if you decide to manually track mileage, just make sure to write down 4. Employees can check pto balances and any upcoming time off right from their phones. 6 if the irs wants to see your documentation to substantiate the mileage.

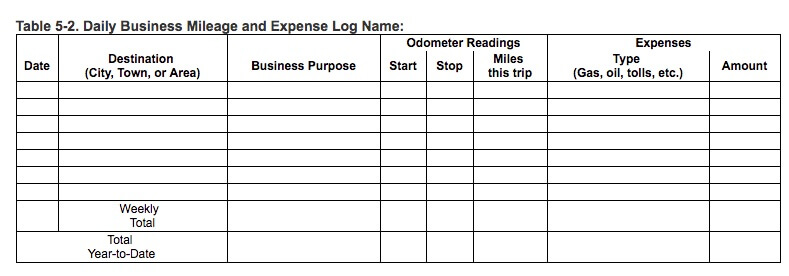

Ad fleet tracking systems from $99. Use these mileage tracker templates to measure your mileage and keep accurate mileage records. Track mileage for the tax year with a tracking app (like everlance).

The date, your odometer reading at the start and finish of. Mileage tracker app and web. Here are the key steps to help you track your mileage.

This means that if your vehicles drive the annual average of 12,000 miles, that deduction amounts to more. For every work trip, make sure you log your mileage, the date, the places you drove, and the business purpose for your trips. The cheaper the solution you use, the harder it will be to resolve these issues.